Bad Faith or Protection? Fighting for Aunt Jean’s Rights Against AARP/New York Life

Part II an account of what happens when a company

questions mental capacity—but only when it costs them.

I couldn’t believe what I was reading.

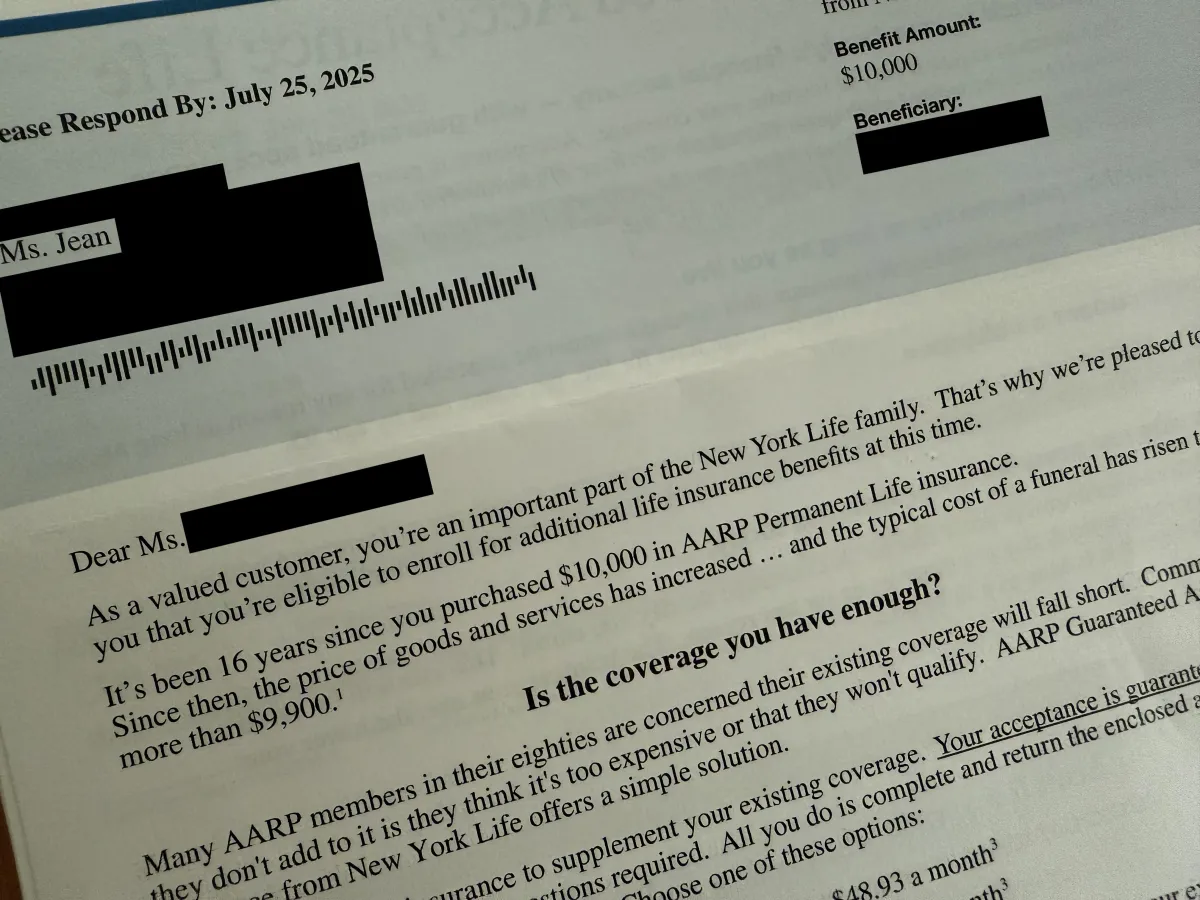

A letter addressed to my 85-year-old Aunt Jean, recently challenged for her mental capacity, arrived from AARP/New York Life Insurance. Right there in the center of the page, in bold print:

“Is the coverage you have enough?”

And near the end, in bold soft blue font:

“Enroll for your additional benefits today.”

Same woman. Same policy. Same recently updated address.

They say she may be too cognitively impaired to cancel the policy.

But they’re perfectly happy to invite her to increase it.

Let that sink in.

But I’m getting ahead of myself…

Here’s how it continued to unfold.

A Routine Update Turns Into a Battle

Three days before my Aunt Jean signed her Power of Attorney, she completed a live video interview with two representatives from the Social Security Administration to verify her identity and request a replacement Social Security card. She answered every question and successfully completed the process.

On May 14, 2025, she executed a Power of Attorney. A week later, on or about May 22, 2025, we contacted New York Life Insurance—just as we had done with her bank, pension, annuity, and health insurance providers—to notify them of her updated contact details.

New York Life made no mention of any cognitive concerns at that time. They processed her updated mailing address, phone number, and email address. We also submitted a beneficiary update, which we later learned had not been applied. Weeks later they notified us that they couldn’t read the original fax dated May 30, 2025.

The Policy Jean Never Needed

When we called to cancel a policy she never needed in the first place—one that cost $61 per month and that she had been paying into for over 15 years—we were told she would receive the cash value of $4,490.93. We followed their instructions and submitted the cancellation request.

Let me be clear: this wasn’t a complex financial decision. This wasn’t about calculating tax liabilities or managing a portfolio. She was simply saying, “I don’t want this policy anymore.” She already has money to cover her desired final expenses at death.

A Sudden Reversal

Instead of honoring her cancellation, New York Life sent a letter dated June 11, 2025 that read:

“During a review of a recent request, we were made aware that the above listed owner may have a possible cognitive impairment.”

They requested an Attending Physician's Statement.

We complied. Her local doctor completed and faxed their form on June 23, 2025. But before we even received a copy of that report, Jean signed a notarized cancellation request dated June 24, 2025. When the notary asked what the form was, Jean said, “It is a request to cancel the policy.” The notary confirmed her identity and understanding of the document.

Weaponizing a Physician’s Opinion?

When we received the Attending Physician’s Statement, we saw the doctor had checked the box indicating that Jean was not of sound mind on May 14, 2025—the date of her POA.

New York Life followed up with three nearly identical letters—one to Jean, one to me, one to my mother—stating:

“We have received information indicating that the owner has experienced a cognitive impairment that impacts their ability to make financial decisions… If you have any additional documentation, such as court-appointed documents or other relevant information, we encourage you to submit it for further review.”

So, we did.

We submitted the signed and notarized cancellation request. We received no response.

An Updated Attending Physician Statement —Still Ignored

Jean’s next doctor’s appointment was July 8, 2025. The staff was floored. No wheelchair. No walker. Her mobility and energy were visibly improved thanks to consistent care, therapy, and family support. The power of love is real.

During this visit, with her in the room, her physician signed a new Attending Physician’s Statement. This time, the box was checked:

“I attest to the fact that Jean Perry-Becton is of sound mind to make any and all financial decisions as of the signature date below.”

That day she also signed a new Cancellation Request. Both forms were submitted that day—one set uploaded through New York Life’s online portal and another sent via email to the Policy Research Team.

As of Today, Still No Response

We have received no acknowledgment of the following:

The June 24 notarized cancellation request

The July 8 Attending Physician’s Statement affirming that she was of sound mind to make "financial decisions"

The July 8 signed Cancellation Request Form

The Ironic Kicker

While we wait, two things happened:

I received an envelope from AARP/New York Life inviting me to purchase life insurance. Off to the shredder.

Jean received that letter you see above, inviting her to increase her coverage—because her $10,000 AARP policy “might not be enough.”

Let that sink in.

They claim she may be too cognitively impaired to cancel her current policy—but are perfectly willing to sell her more insurance.

When it benefits them, she’s competent. When it costs them, she’s not.

This Is What Bad Faith Looks Like

New York Life’s refusal to honor multiple legal documents—including a notarized cancellation, th recent physician's statements, and a clearly stated cancellation request—is not protection. It is obstruction. It is exploitation under the guise of policy.

Given the length of time she’s had the policy, —more than 16 years—it’s quite possibly she’s already paid more in premiums than the $10,000 policy is worth.

What Can You Do?

Be vigilant: If you’re caring for an elder, monitor every financial and legal transaction. Companies count on your fatigue.

Document everything: Keep a paper trail of calls, forms, notarizations, and statements. You may need to prove what should be obvious.

Know your rights: Insurance companies are regulated. You can file complaints with your state’s Department of Insurance if you suspect bad faith.

Speak up: Exploitation thrives in silence. Tell your story. Tell theirs.

This is what advocacy looks like. Sometimes it’s loud. It has to be.

Why This Story Matters—Even If You’re Focused on Your Own Healing

When you're navigating the aftermath of a breakup or divorce, the world doesn’t stop to give you space. You’re still the one managing the bills. Still the one showing up for family. Still the one advocating for people who can’t always advocate for themselves.

Aunt Jean’s story is about more than an insurance dispute—it’s about Accountability to what matters, Alignment with your values, Communication with clarity and confidence, and Trusting your instincts even when the system tries to wear you down.

This is the invisible load so many accomplished women carry—especially in seasons of transition. And that’s exactly why I created the Joy! A.A.C.T.™ Framework: because joy isn’t just about what you leave behind… it’s also about what you choose to carry forward—and how.